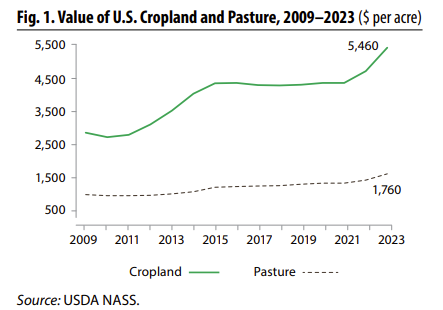

Increases in values for various categories of farmland as an average in the state topped 60 percent in some divisions, according to USDA data for 2019 when compared to 2023. Overall figures for 2024 are expected to be released by the department of agriculture in early August.

Statewide averages showed solid rates of gain over roughly the same pre-Covid to post-Covid period. USDA compiled averages for cropland value in the state showed a per acre value of $3,440 in 2023 compared to $2,160 in 2019, an increase of 59%. Dryland crop ground values went up 62% from $2,050 to $3,320 an acre. irrigated cropland was up 41% from $3,320 per acre to $4,700, And pasture value was up 54% from $1,390 per acre in 2019 to $2,250 in 2023.

A report from Frontier Farm Credit for Eastern Kansas released in July said farmland values in the region made modest gains over the past six months according to the latest Benchmark Farm Value Trends Report issued by Frontier Farm Credit and Farm Credit Services of America (FCSAmerica). Values for Kansas farmland have shown an average increase of 2.2% in the past six months and 9.6% in the past 12 months.

“The combination of higher interest rates and tighter margins for grain producers is having an impact on cropland values,” said Tim Koch, Frontier Farm Credit executive vice president of business development.

The valuation of agricultural land in Kansas is determined by Kansas law, and based on the productive potential directly attributed to the Natural capabilities of the land instead of fair market value determined by commercial sales. cultivated land is valued using an average of the landlord share of net income with soil types used to recognize land productivity potential. for grassland, and 8-year average of the landlord share of the net rental income is used, with productivity established by use of the grazing index assigned to each soil type. and either case the resulting a your average landlord net income is divided by a capitalization rate to arrive at the appraised value.

Several years of strong profitability created optimism in the real estate market and helped to offset the impact of the Federal Reserve’s rate hikes in late 2022 into 2023, Koch said. The market continues to benefit from willing buyers competing for limited land. But as grain prices have fallen, attention is shifting to a more challenging economic environment.

State-by-State Comparisons

As a whole, benchmark values ticked up an average of 0.07% across Iowa, Kansas, Nebraska, South Dakota and Wyoming, the five states served by Frontier Farm Credit and FCSAmerica.

Since January 2024, land values made modest gains in eastern Kansas, Nebraska, South Dakota and Wyoming. In Iowa, which generally is on the leading edge of market trends, values declined for the first time in five years. Despite the pullback, Iowa’s real estate values are up nearly 60% since 2019. Across all five states, values remain at or near record levels.

Dane Hicks is a graduate of the University of Missouri School of Journalism and the United States Marine Corps Officer Candidate School at Quantico, VA. He is the author of novels "The Skinning Tree" and "A Whisper For Help." As publisher of the Anderson County Review in Garnett, KS., he is a recipient of the Kansas Press Association's Boyd Community Service Award as well as more than 60 awards for excellence in news, editorial and photography.