With the legislative session just around the corner, Kansas House Democrats are pushing a big property tax increase on cars as well as on farms and other businesses.

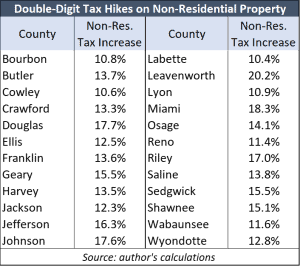

Kansas House Democrats have proposed an amendment to the Kansas constitution that would shift approximately $308 million from residential real estate to other types of property, resulting in an average 11% increase on motor vehicles, farms, and all other businesses.

House Minority Leader Vic Miller (D-Topeka), speaking on behalf of his caucus, is proposing a constitutional amendment to reduce the assessment ratio on residential property from 11.5% to 9%. Miller acknowledges the $308 million tax increase on farms and other businesses, telling the Topeka Capital-Journal it should be even higher — while suggesting it’s about “fairness.”

“While it might seem unfair to some, it’s actually not fair enough,” Miller said.

The $308 million tax shift could be even higher. The calculations are based on each taxing authority increasing its mill rate to offset the decline in residential property tax.

Dave Trabert, CEO of the Sentinel’s parent company, Kansas Policy Institute, notes in a piece for KPI that Miller’s suggestion is disingenuous.

“He justifies the shift by claiming residential property owners are paying a greater share of the tax burden than they once did; however, that is a consciously deceptive claim,” Trabert wrote. “Residential tax collections have increased because home values have grown faster than the value of other classes of property. Miller makes it sound as though farms and other businesses aren’t paying their fair share, even though he knows that all other classes of property are already subsidizing homeowners.”

Homeowners collectively pay 53% of all property tax, but they have 73% of the total appraised value in the state. In other words, all other property owners are already subsidizing residential property. House Democrats want to make it worse.

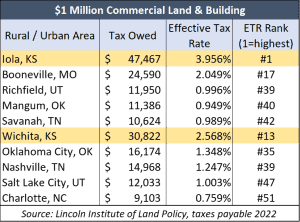

Commercial & Industrial property (including machinery and equipment) accounts for 15% of appraised value but pays 24% of the taxes. Agriculture Land and Improvements represent 4% of the appraised value but pay 8% of the tax. House Democrats’ proposal would exacerbate the already disproportionate share of taxes paid by non-residential property owners.