According to the website Kansas Institute for Politics at Washburn University, Kansas Congressional Rep. Sharice Davids recently released her third video ad in which she talks about “price gouging” and inflation.

Sharice Davids: “The Price Gouging Prevention Act. It’s a mouthful. It’s meant to put more food on your table and keep more money in your pocket.”

“I’m Sharice Davids. Increased grocery prices, sometimes with less in the package, are hurting Kansas families. It’s called greedflation and I’m working to stop it.”

I approve this message from stopping price gouging to capping drug costs like insulin at 35 bucks. Helping Kansans cope with high prices is my highest priority.

Food Margins Shrink

Sharice Davids is following the example of Presidential candidate Kamala Harris, when Harris made the same claims in August about rising grocery bills.

Joel Griffith wrote about “Food Profit Margins Shrink, but Harris Blames Them for Rising Grocery Bills” in his Aug. 29 article at the American Institute for Economic Research.

From Griffith’s article:

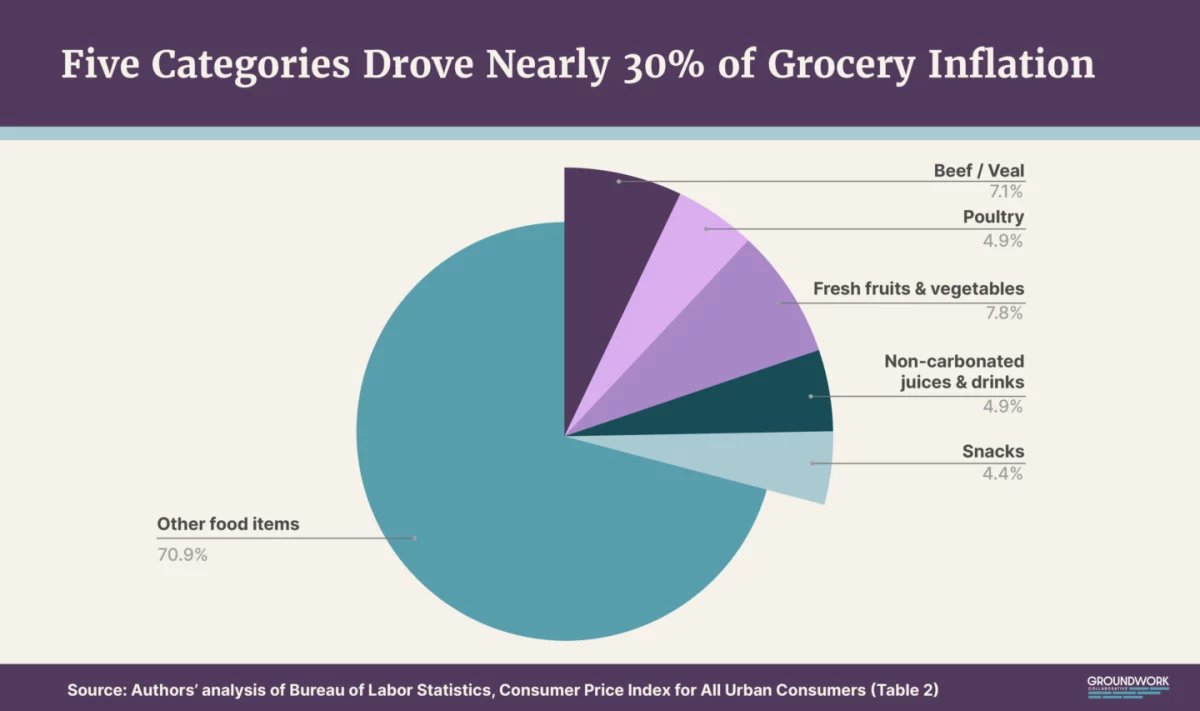

Profit margins are shrinking as food manufacturing costs rose 28.4 percent since January 2020, exceeding the 26.3 percent retail price hikes on food items. Grocery store profit margins sank to 1.6 percent in 2023, the third consecutive year of decline after peaking at 3.0 percent in 2020.

In other words, grocer profit on $100 of sales is just $1.60. Profit margins contracted as overall food inflation totaled 20.6 percent in those three years. The biggest grocers have experienced this margin crunch. The Kroger Co. — the nation’s largest traditional supermarket — eked out an operating margin of 1.93 percent this past year, a margin lower now than it was pre-pandemic. These trends are the opposite of gouging.

Inflationary surge

Griffith explains the surge in inflation that Davis is ignoring in her votes in Congress to greatly expand federal spending:

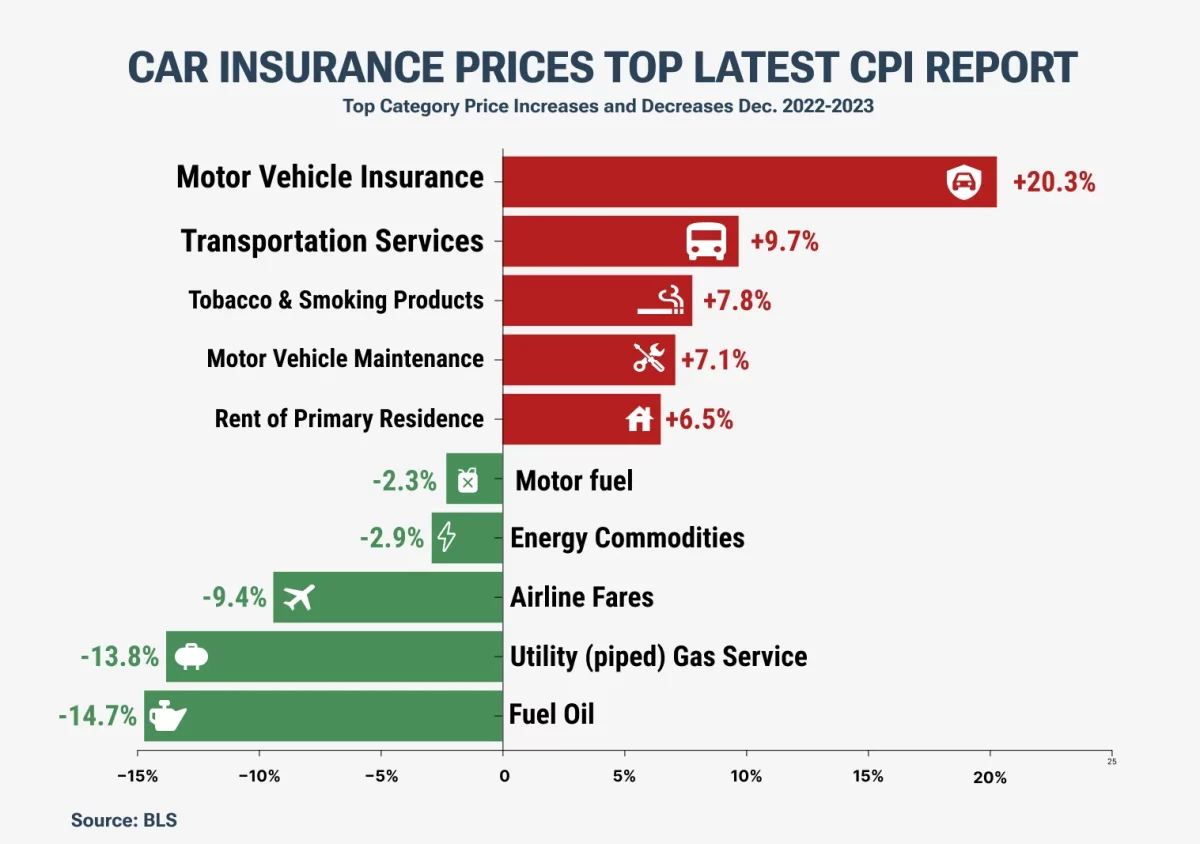

The inflationary surge of the post-COVID era is largely a direct result of the explosion of government spending beginning in 2020. The Federal Reserve financed much of this spending by ginning up its digital printing presses to purchase government bonds alongside a myriad of other assets — from mortgage-backed securities to corporate debt.

The flood of new money coursed through the economy. The M2 money supply swelled by 40 percent in just two years. More dollars chasing goods and services ultimately resulted in dramatic price hikes.

When will Davids assume blame for her inflationary votes in Congress?

Davids’ ad is remarkable since she shows no understanding that her votes in Congress for huge spending increases are at the heart of the inflationary surge.

Again, quoting Griffith:

It’s time political leaders admit their own culpability in the shrinking purchasing power of the dollar at the grocery store. Blaming painful price increases on the very entities responsible for the most bountiful, readily accessible supply of sustenance in human history is woefully misleading. Imposing price controls is a demagogic solution harmful to farmers, processors, grocers, and families.

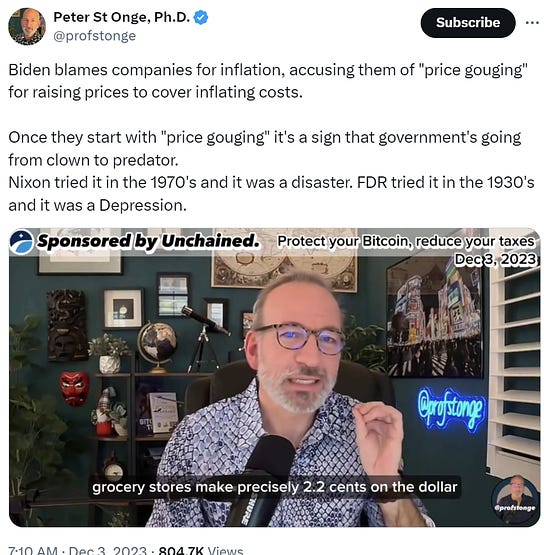

Peter St. Onge on “Price Gouging” and Inflation

Listen to economics in plain English from Dr. Peter St Onge:

Related

Why Are Grocery Bills So High?, Madeleine Rowley, The Free Press, Sept. 11, 2024.

Deficit spending, not ‘price-gouging,’ is driving inflation, Tracey C Miller, The Hill, Aug 31, 2024.

Food Profit Margins Shrink, But Harris Blames Them for Rising Grocery Bills, Joel Griffith, American Institute for Economic Research, Aug. 29, 2024.

‘Bidenflation Blame Game’ report challenges Dems’ claims of corporate price gouging, Carson Swick, New York Post, June 27, 2024.

Corporate greed not to blame for price pressures, Fed study shows, Reuters, May 13, 2024.

Earl Glynn – Watchdog Lab

Earl F. Glynn is a mostly-retired data scientist, scientific programmer, software engineer and physical scientist living in the Kansas City metro area, and the publisher of the substack Watchdog Lab.