Kansas’s 2024 legislative session can be characterized as a constant back-and-forth between the Legislature and Governor Kelly on tax reform, with several vetoes, failed overrides, and dozens of policies added or scraped at each new bill. Indeed, it seems like a special session is in the offing as the back-and-forth continues. The 2024 Green Book demonstrates why Kansas needs to walk away with reform this year. The election-year politics during these votes have overshadowed tax reform’s core justification: empowering Kansans and boosting Kansas’s economy, which continues to lag behind other states.

The basic economic theory is this: states can create economic opportunities by reducing costs for people and businesses. Those businesses range from the local restaurant down the road to the new entrepreneur and his office to a large company deciding to put a new headquarters in Kansas (without additional government subsidies). More people choosing to do business in Kansas at lesser costs leads to more jobs, higher wages, and standard of living increases.

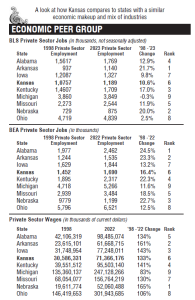

Kansas’s failure to successfully implement tax reform comparable to other states is reflected in its poor statistics. According to the Bureau of Labor Statistics (BLS), between 1998 and 2023, Kansas ranked 41st for private-sector job growth (Page 4-5 of the Green Book). Kansas has the lowest growth rate of its neighboring states. Colorado, by comparison, ranked #9 with growth of 42.3% compared to Kansas’s 10.6%. #1 this year was again Utah at 72.1%.

The Bureau of Economic Analysis (BEA), which has slightly different measures and is thus a year behind the BLS numbers, pinned Kansas at 44th for private-sector job growth from 1998 to 2022 (Page 6-7). Over this same time, the BEA reports that Kansas was 40th for wage growth (Page 8-9). For comparison, the 50-state total was a 173% growth in wages, but Kansas is at 133% and the non-income-taxing states are at 229%.

Between 2000 and 2023, Kansas lost a net of 197,492 during domestic migration (Page 12-13). That is, in the broad picture of people moving in and out of the state, Kansas lost 7% of its 2023 population in people choosing to leave the state over that time period.

The second half of the Green Book gives more insight into why Kansas’s performance is poor. In 2022, Kansas spent $4,941 per resident, while non-income taxing states were able to provide the same basic basket of public goods and services for an average of $3,113 (Page 18-19). Less spending means less taxation, which in turn reduces the cost of government on the people.

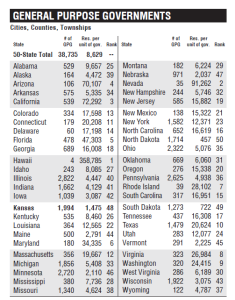

Kansas’s spending is going towards its rank as the 3rd highest number of state and local government employees per capita and 3rd highest number of general-purpose governments in the country (Page 20-22). In many Kansas counties, government jobs account for more than a third and sometimes more than half of total jobs.

Between 1992 and 2020, 72 of Kansas’s 105 counties experienced property tax collections more than double despite a decline in population. Property taxes are also high across the state. When compared with similarly sized rural towns across the country, a city the size of Iola has the highest property tax on commercial properties and the fourth-highest property tax on homestead properties in the nation.

The relationship between the size of government and economic growth is as true today as we first wrote for the Wall Street Journal in 2012 – States that spend less, tax less…and grow more. Kansas’s high taxes support the big size of state and local government. The consequence of these taxes is that people and businesses choose to move and establish their places of work elsewhere.

The Green Book tries to capture this distinction by comparing states with and without an income tax. In 2022, states that tax income spent 77% more per resident than states without an income tax. According to the BLS again, between 1998 and 2023, private-sector jobs in non-income taxing states grew by 49.7% compared to 19.9% in income-taxing states.

Kansas can afford income tax reform to at least match the dozens of other states that have already lowered their rates. The end result will be taking the first steps to make Kansas a more formidable economy for each Kansan.

Ganon Evans – Kansas Policy Institute

Ganon Evans is a Policy Manager and Analyst in the Kansas Policy Institute’s Sandlian Center for Entrepreneurial Government.