TOPEKA – While the State of Kansas sits on its biggest pot of tax-generated spare cash in state history – some $2.8 billion – you’ll save an extra $2 for every $100 in groceries you buy as of the first of this month.

Yee haw, most Kansans are saying.

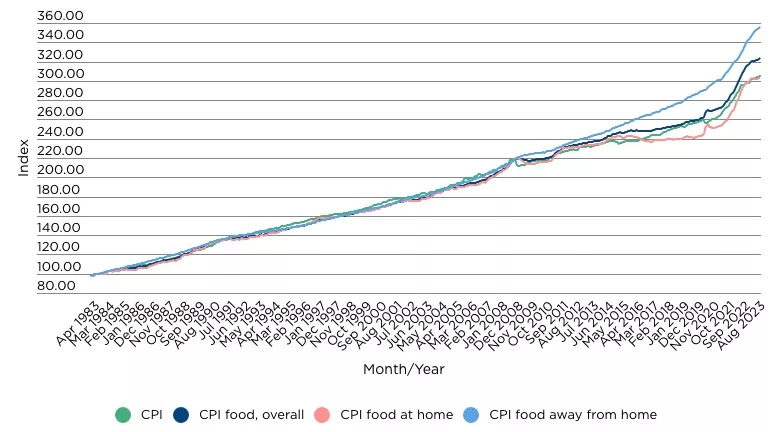

With 18 months of inflation driving some goods to nearly double their price of just a few years ago, bankers and others in the state say saving two percent in the recent food sales tax reduction will probably be barely noticeable.

“Nobody’s said anything about it,” said a checker working at the Country Mart grocery store in Garnett last week. “Maybe nobody noticed?”

For starters, the reduction doesn’t account for sales taxes enacted by local governments – cities and counties across the state add on varying amounts – groceries purchased in Garnett, for instance, carry an added sales tax of 1 percent for Anderson County and ½ percent for the city.

The reduction in sales tax on food dropped the state’s 6.5 percent sales tax rate to 4 percent in 2023 and to 2 percent on January 1, and will decrease in January next year to 0. The move was an option for tax relief, particularly for families who buy lots of groceries, and one of the rare compromises reached between Democrat Governor Laura Kelly and the Republican-controlled state legislature – one that according to Kansas Department of Revenue estimates will save Kansans $12.5 million per month in 2024. But inflation-spiked prices of groceries and other goods make the savings negligible, unless a household buys a large amount of groceries.

“I think you can say that it is an admirable effort and uniform across everyone who buys groceries,” said Jeff McAdam of GSSB in Garnett. “But the result is negligible compared to the way other prices have shot up.” McAdam noted economic statistics that estimate most households have seen a $700 per month increase in costs over the past two years.

Scott Cooper with Patriots Bank in Ottawa agreed.

“Anytime you can put money back into people’s pockets it’s a good thing,” Cooper said. “But, would they really notice? I’d say no, especially with everything else increasing.”

The specifics in the law can be a little prickly. The tax on donuts is reduced unless they with come with a napkin. You’ll pay full tax on deli sandwiches sold packaged by a manufacturer, but not if they’re prepared by the seller. Wedding cakes sold without utensils get the tax break, but not wedding cakes with knife, fork, or spoon.

The Bureau of Labor Statistics tracks the Consumer Price Index, and shows some foods higher and some lower over the year from Nov. 2022 – Nov. 2023. The biggest increases included: frozen noncarbonated jusices and drinks up 18.6 percent; food from vending machines and mobile vendors up 14.6 percent; uncooked beef roasts up 12.5 percent; uncooked beef steaks up 9.1 percent and beef and veal up 8.7 percent. Items that decrease the most in price over that period included eggs, down 22.3 percent; lettuce down 10.2 percent, apples down 5.8 percent; tomatoes down 4.4 percent and fresh vegetables down 3.1 percent.

But there’s anecdotal evidence the CPI may be underestimating the true impact of higher prices on those shopping tapes. While the CPI shows a statistical increase of 19 percent for groceries between May 2020 and August 2023, shoppers surveyed last summer by the New York Times found some estimated their grocery bills had jumped between 42 and 66 percent, accounting for different items purchased by different shoppers.

Anecdotal comparisons abound among about every grocery shopper. One local shopper notes her favorite store sold individual serving packs of tuna for $1 pre-Covid; and that price is now $1.65.

What’s not known but broadly recognized is the additional revenue in every state that’s been generated by the flat percentage sales taxes as they’ve been applied to rapidly escalating prices of goods over the past two years. Kansas collected $291 million more in sales tax in 2022 than in 2021. Average monthly state sales tax collections in 2022 were some $287 million per month. That figure averaged $282 million through the first 9 months of 2023, the latest figures compiled, which does not yet include the holiday retail season.

Dane Hicks is a graduate of the University of Missouri School of Journalism and the United States Marine Corps Officer Candidate School at Quantico, VA. He is the author of novels "The Skinning Tree" and "A Whisper For Help." As publisher of the Anderson County Review in Garnett, KS., he is a recipient of the Kansas Press Association's Boyd Community Service Award as well as more than 60 awards for excellence in news, editorial and photography.

My anticipation is that the appreciated-but-picayune tax saving on my groceries will quickly be negated as Douglas Co. taxing authorities continue their abusive, exploitative spending on increasingly inane (in my opinion) goals.

As for “Kansas sits on its biggest pot of tax-generated spare cash in state history…”, the State needs to get off the pot and commit many more dollars to improving/expanding Kansas’s hospitals (plus the Community Mental Health Centers that initiate referrals) for persons suffering from mental illness. It’s obvious that Douglas Co. is awash in homeless people, a number of whom (based upon my reading local police reports) show signs of impairment that seem attributable to prolonged drug and/or alcohol abuse.

Individual cities’ taxpayers who fund municipal budgets are being sorely stressed to pay for the delusional efforts of local governments to meet these needs. The State ought to step up to the challenge; it increases constantly.