We can rest assured that the special session of the state legislature beginning Tuesday, called to reportedly approve a plan to return some tax money to Kansas taxpayers, won’t begin the way it should – with an apology from Kansas Governor Laura Kelly.

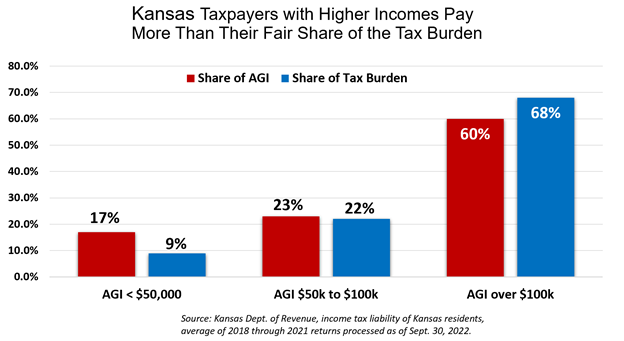

For five years now and particularly in regard to 11 bills Kelly thwarted which were designed to bring relief to over-taxed Kansans, our supposedly “moderate” governor vindictively continued to veto efforts by the legislature to return part of the state’s growing surplus to the people who paid it in. Kelly’s performance on tax relief has been abysmal, even as consumer prices skyrocketed under the national mismanagement of the Biden Administration and sucked hundreds of dollars more a month from household budgets. Indeed, Kelly may hold the record for most tax relief plan vetoes by any governor in state history.

Now, with nearly a $4 billion surplus of Kansas taxpayer money sitting in the bank and Democrat legislators running for election in a few months who would otherwise be vulnerable to voter backlash due to Kelly’s lack of conscience, the governor has decided to speedily bring the legislature back into session to throw taxpayers of bone that she hopes will benefit her party this November.

And though the Kansas media which have coddled Kelly since her first inauguration and protected her from criticism seem hesitant to play back her history on tax relief, some of us have longer memories.

Kelly vetoed two tax relief bills in 2019, one was SB22 which would have cut sales tax and expanded itemized deductions; a near mirror version of the bill from the House was also scuttled. In 2020 she vetoed the Taxpayer Protection Act, which would have prohibited property valuation increases just because an owner kept a property in good repair and would have kept county appraisers and the state board of tax appeals from raising valuations based on valuation appeals.

The 2021 legislature overrode Kelly’s veto of SB50, in which she tried maintain Amazon and Etsy’s advantage over Kansas brick and mortar retailers by not charging sales and use taxes.

As the state’s surplus of taxpayers’ funds passed the $3 billion mark, legislators tried a sweeping and multi-faceted omnibus tax relief bill in 2023 which would have knocked down sales taxes, allowed property and personal property tax exemptions and reduced penalties and fees the state collects and cut taxes for businesses with whom the government competes. Kelly vetoed it.

But it was the 2024 session where Kelly’s full on disdain for the Kansas taxpayer became the stuff of legend. In five straight vetoes,(HB 37, HB 2098, HB 2096, HB 2036, HB2284) Kelly thwarted Republican legislators efforts to ease Financial pressure on taxpayers with property tax relief, sales tax on groceries, taxing Social Security benefits, property tax relief for senior citizens and veterans, even tax exemptions on ATVs watercraft and wheelchairs. legislators tried to develop a Single rate income tax system that would actually benefit those who pay income taxes. Kelly vetoed it all.

The story behind the story is of course Kelly’s obsession with Medicaid expansion in Kansas, and the embarrassment she suffers among the country’s Blue State governors that she has failed to implement massive social program expansion in Kansas. Kelly desperately wants to lower the bar to allow 150,000 additional people, most of whom already have health coverage, to access free health benefits paid for by taxpayers. Republican legislators in Kansas rightfully oppose the expansion, so Kelly in turn keeps up the overbearing tax pressure on the rest of us.

It’s not just unfair, it shows a character deficit not just in the governor but also in the legislators who’ve selfishly withheld their support from five years of veto override attempts for various political reasons. Their names and deeds too should be commonplace as election season blooms.

Kansas may actually get tax relief in this special session, but we won’t hold our breath waiting for the governor’s apology.

Dane Hicks is a graduate of the University of Missouri School of Journalism and the United States Marine Corps Officer Candidate School at Quantico, VA. He is the author of novels "The Skinning Tree" and "A Whisper For Help." As publisher of the Anderson County Review in Garnett, KS., he is a recipient of the Kansas Press Association's Boyd Community Service Award as well as more than 60 awards for excellence in news, editorial and photography.