Double-digit increases in assessed valuations are being used by many local elected officials to sock taxpayers with unaffordable property tax hikes, and legislators can do something about it in the upcoming special session.

The special session on tax relief called by Governor Laura Kelly for June 18 will play out like the movie Groundhog Day, starring Bill Murray. As has happened about a half-dozen times since Kelly took office, the Legislature will pass affordable income tax relief, and Kelly will find an excuse to veto it.

It doesn’t matter to Governor Kelly that tax relief is easily affordable with more than $4 billion in reserves. Losing population and adjusted gross income from domestic migration each year as people flee the 12th-highest tax burden also doesn’t seem to concern her. Kelly sees your taxes as her money to spend, and apparently, a 56% General Fund spending increase during her tenure isn’t enough.

The Legislature should try again in the Special Session. Still, there is no practical opportunity to override her veto, so we know the scene will end with Kelly seeing her shadow and causing six more months of no tax relief.

However, Kelly cannot veto a constitutional amendment on tax relief; it must be approved by two-thirds in both chambers and go straight to the ballot.

Constitutional amendment to limit increases in property valuations

Governor Kelly’s idea of tax relief last year was a measly $250 rebate. This year, her plan is only designed to give the appearance of supporting tax relief so she can use it in the 2024 elections. The ads are easy to predict – ‘I wanted to give you relief, but the Republicans wanted to bankrupt the state. Elect more Democrats.’ (That’s not true, of course, but campaign ads are often not constrained by the truth.)

Last year, the Senate passed SCR 1611 by a vote of 28-11, which would have limited the annual increase in valuations to 4%. The House didn’t act on it.

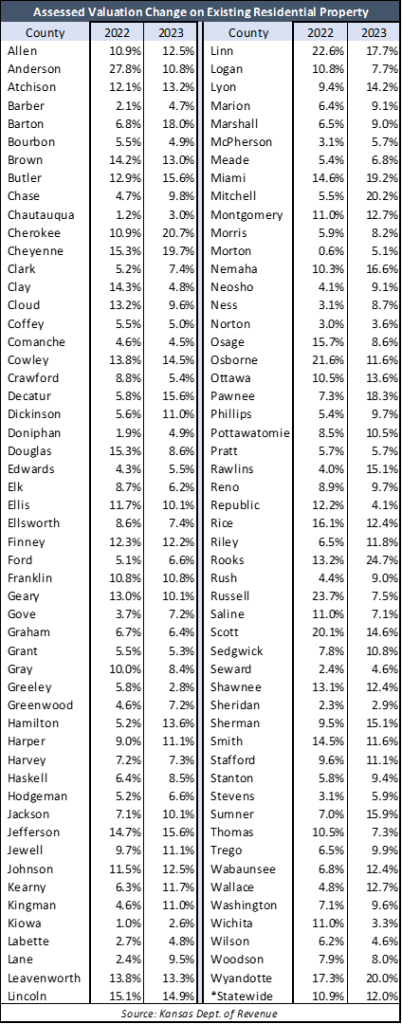

Approving a similar amendment in the Special Session would greatly benefit taxpayers. The table below shows 29 counties hiked residential values by more than 10% in 2022 and again in 2023. Residential values jumped more than 10% in at least one year in another 29 counties.

And in many cases, elected officials claimed to be ‘holding the line’ on property tax – referring only to the mill rate – while imposing large tax increases.

Legislators passed the Truth in Taxation Act in 2021, which forces local officials to vote to exceed the revenue-neutral rate and create a record of their increases. Truth in Taxation has helped stem the property tax increase in some counties, but dishonesty persists in many places.

A constitutional amendment limiting the increase in assessed valuations would provide much-needed relief, and Governor Kelly cannot stop it with her pen. It would also clearly identify whether each legislator sides with taxpayers or the local elected officials who want to keep raising property taxes.

Dave Trabert – Kansas Policy Institute

Dave Trabert is Chief Executive Officer of Kansas Policy Institute, where he also does research and writes on fiscal policy and education issues. He is the lead author of two books: Giving Kids a Fighting Chance with School Choice and What was Really the Matter with the Kansas Tax Plan, and his other published work includes “A Five-Year Budget Plan for the State of Kansas,” “Student-Focused Funding Solutions for Public Education,” and “Removing Barriers to Better Public Education.” He also writes for The Sentinel, which is owned by KPI.