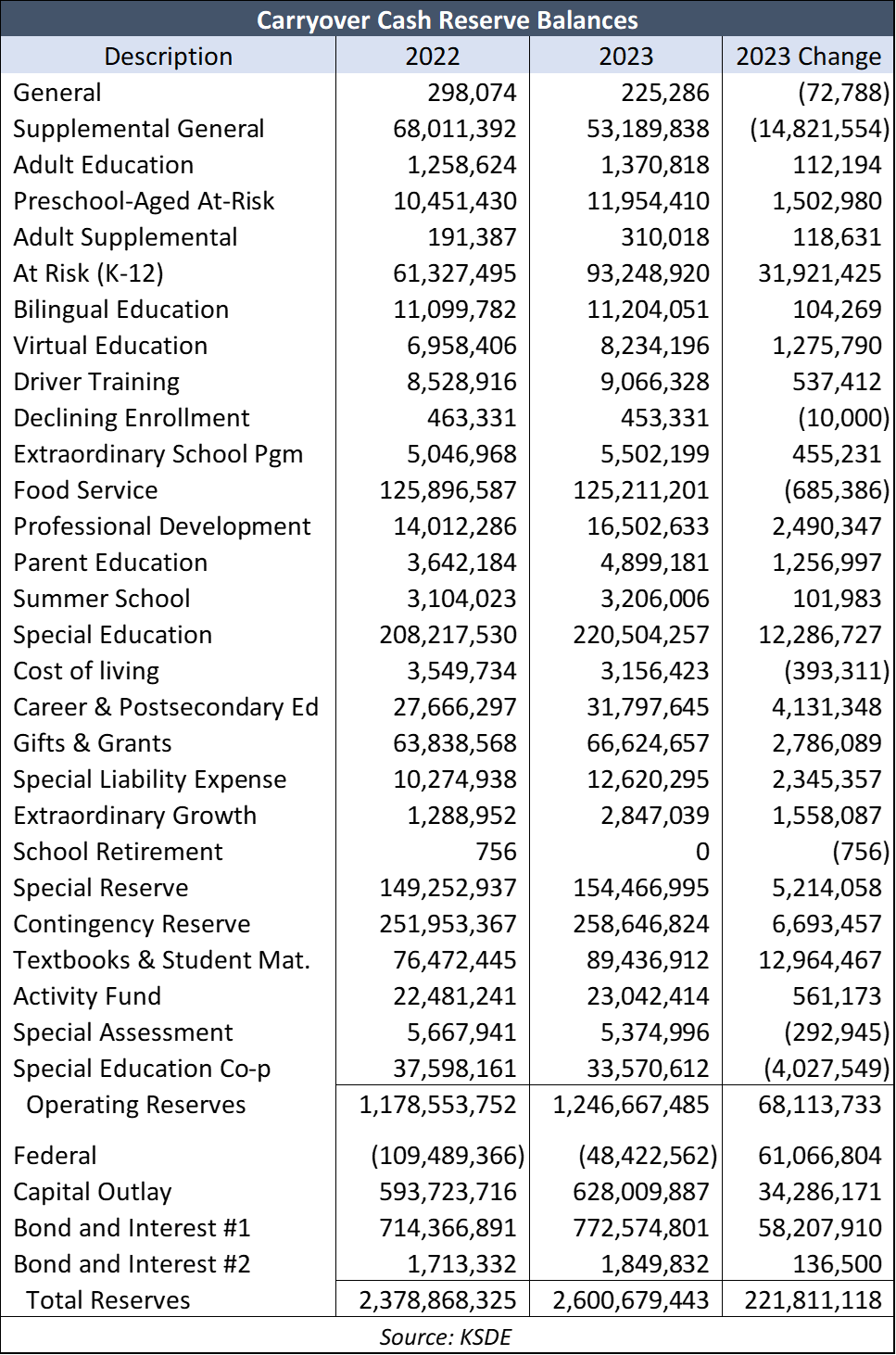

New data from the Kansas Department of Education show school districts collectively added $68 million to their operating cash reserves in the last school year, bringing the total to $1.25 billion.

Operating cash reserves exclude balances in Capital Outlay, Federal, and Bond & Interest. Funds operate like checking accounts; the ending balance increases if more money goes in than is spent. Taken collectively, the increase in operating cash reserves indicates that school districts did not spend all of the state and local tax dollars provided last year.

Some fund balances, including Supplemental General and Contingency, have no restrictions. The balances in some funds, like At-Risk, Special Education, and Food Service cannot be spent on anything else, but districts can tap into the money by not transferring General Fund money to them and spending down the balance.

Some of the largest increases include Blue Valley ($9.4 million), Wichita ($9.3 million), Shawnee Mission ($9.2 million), Lawrence ($8 million), Emporia ($3.7 million), and Salina and Olathe each added $3.5 million.

Special Education, included in operating cash reserves, increased by $8 million

Some superintendents and the state school board association have made a big deal about not getting enough aid for special education. Yet even the special education fund grew by more than $12 million. Special Education Co-Op funds declined by $4 million, leaving a net increase of $8 million.

State law calls for the Legislature to reimburse districts for 92% of their ‘excess costs’ after allowing for federal aid and state aid provided for the regular education of special education students. The reported reimbursement percentages have been below 92%, but the calculation does not count all of the money related to special education. Counting all funds provided, school districts receive more than 92% reimbursement.

Ironically, some of the state’s most vocal critics of state funding increased their special education balances and their overall operating cash reserves, including Blue Valley, Shawnee Mission, Olathe, and Wichita.

Parents and legislators are told that underfunding of special education forces districts to take money away from services for other students, but the changes in operating cash reserves invalidates such claims.

If any regular education services are diminished, it is by the choice of superintendents and local school boards by virtue of having so much unspent aid in prior years.

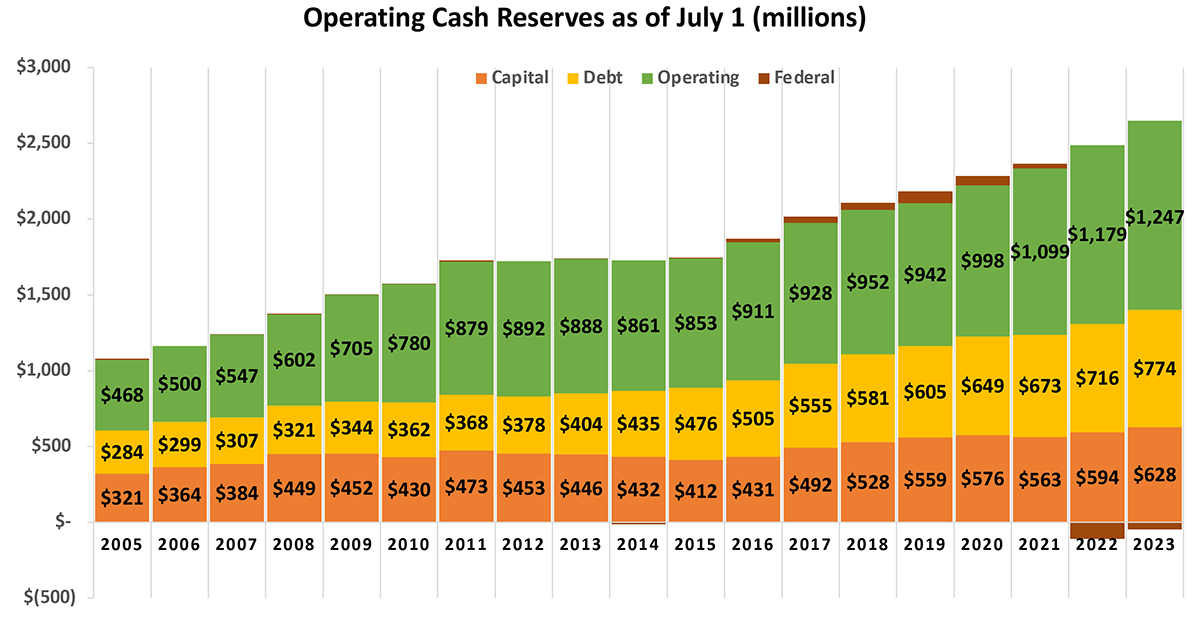

The chart below shows operating cash reserves increased by $779 million since 2005. Even while district officials were in court claiming to be underfunded, they didn’t spend all of the state and local tax dollars provided. Most of that money is either immediately available to spend or can be accessed with good cash management practices.

Cash Reserve charts and fund balances for each district are available at KansasOpenGov.org.

Dave Trabert – Kansas Policy Institute

Dave Trabert is Chief Executive Officer of Kansas Policy Institute, where he also does research and writes on fiscal policy and education issues. He is the lead author of two books: Giving Kids a Fighting Chance with School Choice and What was Really the Matter with the Kansas Tax Plan, and his other published work includes “A Five-Year Budget Plan for the State of Kansas,” “Student-Focused Funding Solutions for Public Education,” and “Removing Barriers to Better Public Education.” He also writes for The Sentinel, which is owned by KPI.