Three reasons the flat tax proposal is better for taxpayers than Gov. Kelly’s plan

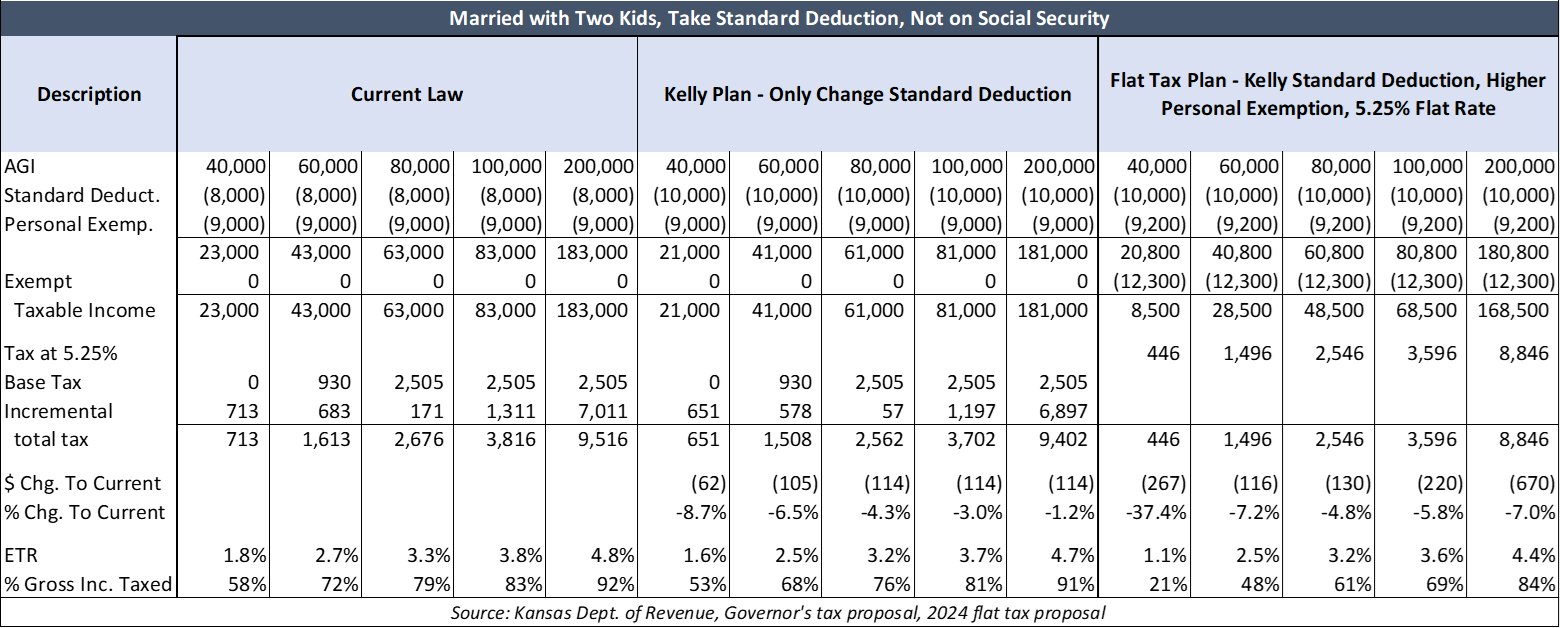

A week into the 2024 Legislative session, the two largest tax relief proposals of the year have been announced. Governor Laura Kelly’s plan increases the standard deduction but keeps the tiered rate system that tops out at 5.7%. The House and Senate Leadership plan has the same increase in the standard deduction, provides a larger personal deduction, exempts the first $6,150 single / $12,300 married from taxation, and a flat rate of 5.25% on taxable income.

Both proposals reduce residential property taxes and eliminate the state sales tax on food and the state income tax on Social Security.

The flat tax proposal is better for taxpayers than Kelly’s plan for several reasons:

- Lower-income families save more money.

- Dropping the top rate from 5.7% to 5.25% makes Kansas more competitive with other states.

- All taxpayers save more money

Lower-income families save more money

The above table models a married couple with two kids taking the standard deduction and not on Social Security at several income levels Under current law, a couple with an adjusted gross income (AGI) of $40,000 has a taxable income of $23,000 and pays $713 in income taxes. Kelly’s proposal with the standard deduction would save this couple $62. That family saves $267 with the flat tax proposal, however.

The biggest difference comes from exempting the first $12,300 from taxation. That change also means a family of four with AGI of $31,700 would pay no tax, but they would pay $394 under Kelly’s plan.

Kansas is more competitive with a 5.25% flat tax

According to the Tax Foundation, fourteen states have individual income tax rate reductions taking effect in 2024: Arkansas, Connecticut, Georgia, Indiana, Iowa, Kentucky, Mississippi, Missouri, Montana, Nebraska, New Hampshire (interest and dividends income only), North Carolina, Ohio, and South Carolina. Two states—Ohio and Montana—will consolidate some tax brackets, and one state, Georgia, will move to a flat tax.

States with lower income taxes have superior economic growth, and that is desperately needed in Kansas. Private-sector job growth in Kansas was ranked #44 between 1998 and 2022. Last year, jobs grew by just 0.6% through November, which is only one-third of the national average.

Everyone saves more money with the 5.25% flat tax

As shown in the above table, the savings in the Kelly plan range from $62 to $114, whereas families save between $127 and $680 with the flat tax.

The dollar savings are larger for those with the highest incomes because they pay the highest tax rates now. A family with $200,000 AGI now pays $9,516 in state income tax, which is an effective tax rate of 4.8%. The family with $40,000 AGI pays $713, which is an effective tax rate of 1.8%. Under the flat tax, the effective tax rates drop to 4.4% and 1.1%, respectively.

Kansas can afford tax the flat tax proposal

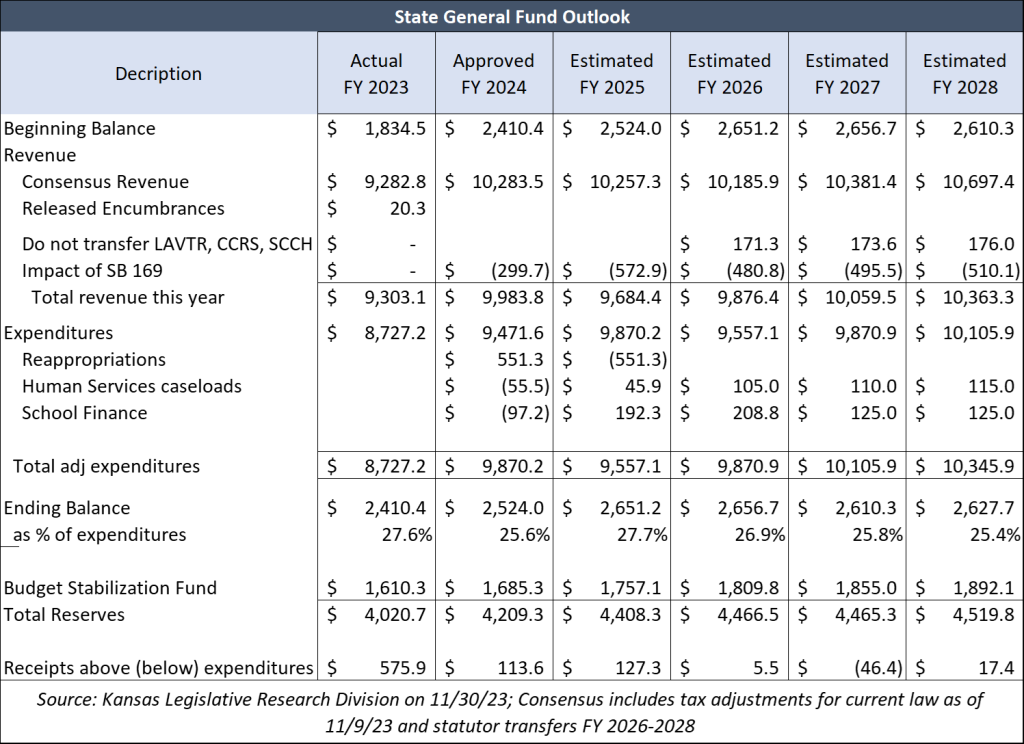

Governor Kelly’s claim that the flat tax will result in large budget deficits is not true.

Analysis by Kanas Legislative Research shows the state would still have a $4.5 billion surplus after three years of flat tax Kelly vetoed in Senate Bill 169.

SB 169 was expected to save about $1.5 billion in its first three full years, whereas Gov. Kelly says her plan would save about $1 billion. The cost of the new flat tax plan could be more than the original because of the increase in the standard deduction, but the state would still have a surplus of about $4 billion.

Ganon Evans – Kansas Policy Institute

Ganon Evans is a Policy Manager and Analyst in the Kansas Policy Institute’s Sandlian Center for Entrepreneurial Government.