Over the last several years Kansas has remained uncompetitive when it comes to property taxes. In some cases, the state even has some of the highest property taxes for certain buildings in the entire country.

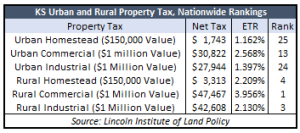

The Lincoln Institute of Land Policy releases an annual 50-State Property Tax Comparison Study, with the most recent release from August 2023 comparing states based on taxes paid in 2022. For Urban taxes, Wichita is Kansas’s data point, and for Rural taxes, Iola is the benchmark. Some states with significantly different tax rates than the rest of the state compared to their largest city – like Illinois and Chicago – have two cities in the Urban ranking. The methodology of the study can be found in their report.

Kansas has the highest property taxes in the country for Rural Commercial properties – $47,467 to be exact. By comparison, the lowest was in Delaware, taxed only at $5,642. Kansas was more than double the 50-state average of $19,941. Rural Homesteads and Rural Industrial properties had similarly high rankings in the comparison.

Urban properties were closer to the middle of the rankings but were all on the higher side. Kansas had the 13th highest taxes on Urban Commercial properties at $30,822, compared to a 50-state average of $22,032.

Property taxes are another operating cost for business, and an addition to the price tag that taxpayers pay on their homes. Reducing property taxes reduces those costs for people and businesses. Several thousand dollars saved could be the difference between a business being able to afford a new employee, or a homeowner being choosing to remain in Kansas instead of joining the nearly 200,000 net people that have left Kansas for other states in domestic migration since 2000.

Much of this comes down to the decision of taxing entities on how much they tax – and how much they spend. Kansas counties with populations between 6,000 and 10,000 people differed in their per-resident spending from a high of $3,038.58 to a low of $949.97. Finding ways to trim costs means passing on relief to taxpayers.

Despite these ongoing issues, progress has been made With Truth-in-Taxation legislation, taxing entities need to hold a public hearing in order to exceed their revenue-neutral rate. Of the 2,563 entities of the state’s roughly 3,900 that KPI received information about from KORA requests, 57.6% weren’t planning on exceeding their revenue-neutral rate. Truth-In-Taxation is a means to an end, but not a definitive solution for the complex issue of high property taxes.

Ongoing legislation with property taxes

A few bills in the Topeka statehouse this year offer opportunities to reduce property taxes.

HCR 5025 and SCR 1611 are both constitutional amendments that would limit valuation increases for property. In 2023, hundreds of thousands of Kansas experienced higher property taxes due to a valuation spike in 2022. Residential properties had a 12.1% increase in assessed value. If this had been limited to a 4% increase, like it is outlined in SCR 1611, taxpayers would see greatly reduced property taxes.

HB 2815 would reduce the mandatory school property tax from 20 to 18 mills and eliminate current Local Ad Valorem Tax Reduction (LAVTR) legislation from the books.

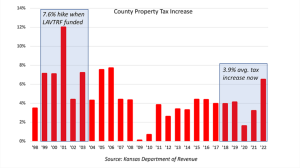

LAVTR did not result in local property tax reductions when it was in place. In the last five years it was funded (1999 – 2003), county-imposed property taxes increased by an average of 7.6%. That is almost twice as much as the current five-year average of 3.9%.

Removing the LAVTR language from the statutes makes sense because the program hasn’t been funded since 2003. Keeping it statute, however, compels its inclusion in the Consensus Revenue Estimates and results in lower revenue estimates than are likely to occur.

Ganon Evans – Kansas Policy Institute

Ganon Evans is a Policy Manager and Analyst in the Kansas Policy Institute’s Sandlian Center for Entrepreneurial Government.